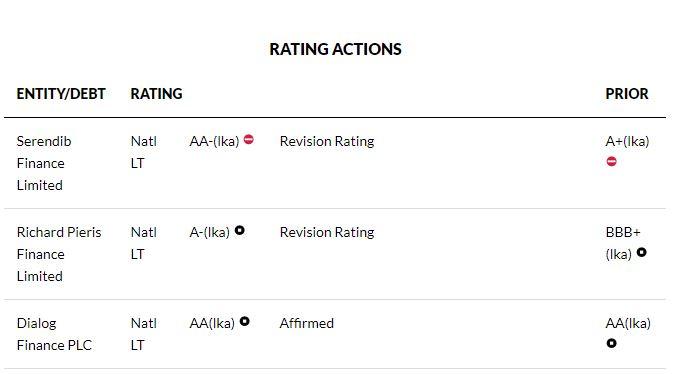

(UTV | COLOMBO) – Fitch Ratings has revised Serendib Finance Limited’s National Long-Term Rating to ‘AA-(lka)’, from ‘A+(lka)’, with a Negative Outlook, and that of Richard Pieris Finance Limited (RPF) to ‘A-(lka)’, from ‘BBB+(lka)’, with a Stable Outlook. Fitch has also affirmed Dialog Finance PLC’s (DF) National Long-Term Rating at ‘AA(lka)’ with a Stable Outlook.

KEY RATING DRIVERS

Serendib Finance Limited

The upward revision of Serendib’s rating stems from the upward revision of the rating on its parent, Commercial Bank of Ceylon PLC (CB), to ‘AA+(lka)’/Negative, from ‘AA(lka)’/Negative, following the recalibration of the agency’s Sri Lankan national rating scale. The recalibration reflects changes in the relative creditworthiness of Sri Lankan issuers following Fitch’s downgrade of the country’s sovereign rating to ‘B-‘/Negative’, from ‘B’/Negative, on 24 April 2020. Revision ratings are used to modify ratings for reasons that are not related to credit quality.

Serendib’s rating is driven by Fitch’s view that its parent, CB, would provide extraordinary support, if required. CB’s ability to support Serendib is reflected in its credit profile, which is underpinned by its standalone strength, and Serendib’s small size. The support assessment also takes into account CB’s full ownership of Serendib, support record via multiple equity infusions and the subsidiary’s increased level of integration with its parent. The Negative Outlook on Serendib reflects the Negative Outlook on CB.

Serendib is rated two notches below its parent because of its limited role within the CB group, with Serendib accounting for less than 1% of CB’s consolidated gross loans at end-2019. It also reflects the absence of a common brand and Serendib’s weak performance.

“We see Serendib’s intrinsic credit profile as being considerably weaker than its support-driven rating due to its small franchise, volatile business model, high risk appetite and weak financial profile relative to peers.”

“We expect CB to inject equity capital to enable Serendib to meet the minimum regulatory capital of LKR2.5 billion by the extended deadline of 31 December 2021. Serendib’s pre-tax profitability has improved, but continued to be weakened by high impairment charges. Its reported gross non-performing loan ratio of 22% at end-September 2019 remained significantly higher than that of the industry. Serendib’s funding profile has limited diversity due to its dependence on bank borrowings; it only recently commented deposit mobilisation,” Fitch said.

Serendib accounted for only 0.5% of domestic finance and leasing sector assets in 2019.

Richard Pieris Finance Limited

RPF’s rating reflects Fitch’s expectation of support from parent, Richard Pieris & Company PLC (RICH), a Sri Lankan conglomerate. This view is based on RICH’s majority 98% effective shareholding and the common brand name. We regard RPF to be of limited importance to RICH, given its limited contribution to the group’s core businesses. There are few synergies between RPF and the group, which is evident in RPF’s smaller share of lending within the group’s ecosystem. Furthermore, RPF’s integration with the group is low, as the subsidiary exercises considerable management and operational independence. In addition, we believe support from the parent could be constrained by RPF’s large size, as its assets represented 111% of group equity and 29% of group assets at end-September 2019.

Fitch views RPF’s intrinsic financial strength to be materially weaker than its support-driven rating due to its weak financial profile, small franchise (around 1% market share), limited operating history and higher risk appetite. Fitch expects RPF’s regulatory non-performing loans ratio (end-September 2019 (1HFY20): 14.4%, FY19: 7.5%) to significantly deteriorate in the near-term due to the coronavirus pandemic and the already-challenging operating environment. This is likely to increase credit costs, which may erode RPF’s profitability (profit before tax/average total assets of 0.2% at end-1HFY20).

Net losses or significant deductions to RPF’s core capital could see its regulatory capital ratios falling below the regulatory minimum (6.5% and 10.5% of risk-weighted assets for Tier 1 and total capital ratios, respectively) as well as below the minimum core capital requirement (LKR2 billion by end-2020). This would require additional capital, either internally from group resources or externally. RPF’s Tier 1 and total capital ratios stood at 10.9% at end-1HFY20, while its core capital was just over LKR2 billion.

Dialog Finance PLC

DF’s rating reflects Fitch’s expectation of support from parent, Dialog Axiata PLC (Dialog, AAA(lka)/Stable), Sri Lanka’s largest mobile-telecommunication and pay-TV operator. This is based on Dialog’s 99% equity stake, DF’s high operational and management integration with the parent and the common Dialog brand. The two notch differential reflects our view that DF is of limited importance to Dialog’s core business, given its evolving fintech business model as well as modest size and financial contribution to the group. Dialog’s credit profile and ability to support DF is reflected in its rating, which is underpinned by its standalone strength.

DF was acquired in 2017 to support Dialog’s aspiration to expand its parent’s digital financial services in Sri Lanka via the fintech business model. However, DF is yet to commence its intended role and we do not expect the segment to provide a significant contribution to the group’s core business in the near to medium term.

“We believe DF’s intrinsic financial strength is materially weaker than its support-driven rating due to its poor financial profile, small franchise – with market share of around 1% – short operating history and high risk appetite. Device financing is DF’s core product, accounting for 44% of its gross loan book and 54% of DF’s stage 3 loans at end-2019. DF has weak asset-quality metrics, with a stage 3 loan/gross loan ratio of 40.1% and a regulatory six-month non-performing loan ratio of 35%. We expect asset-quality metrics to remain under pressure in the near-term due to the coronavirus pandemic and the already-challenging operating environment. This is likely to increase credit costs and further weaken DF’s profitability,” Fitch said.

DF’s debt/tangible equity fell to 0.4x in 1Q20, from 0.6x in 2019, having received LKR701 million of rights issue subscription funds from its shareholders in March 2020 to meet the LKR2 billion regulatory minimum. We expect Dialog to infuse the balance amount to enable DF to reach the regulatory core capital level of LKR2.5 billion by end-2021. We forecast the company’s leverage to remain stable, as its lending plans are likely to be mostly funded by equity capital rather than debt and deposits.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to positive rating action/upgrade:

Serendib Finance Limited

A significant increase in Serendib’s strategic importance to its parent through a greater role within the group.

Richard Pieris Finance Limited

An improvement in RICH’s credit profile or RPF becoming strategically important to its parent through a significant increase in RPF’s role.

Dialog Finance PLC

A significant increase in DF’s strategic importance to its parent through a greater role within the Dialog group.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

Serendib Finance Limited

Weakening links with the parent or a downgrade of CB’s National Long-Term Rating.

Richard Pieris Finance Limited

If RICH’s ability to support RPF were to decline in Fitch’s view. This may occur if RICH’s credit profile were to weaken in Fitch’s assessment or if RPF’s size relative to that of its parent were to place greater constraints on RICH’s ability to support its subsidiary. Any perceived weakening in RICH’s propensity to support RPF could also be negative for RPF’s rating. This could arise from weakening links with the parent that result in wider notching and may be in the form of a significant decline in parental control or weak performance at RPF that raises questions over the business’s attraction for the parent over the long term.

Dialog Finance PLC

If Dialog’s ability to support DF were to weaken, as signalled through a downgrade of Dialog’s National Long-Term Rating; but we believe such a scenario is unlikely to occur in the medium term. Any perceived weakening in Dialog’s propensity to support DF could also be negative for DF’s rating. This could arise from weakening links with the parent that result in wider notching and may be in the form of a meaningful reduction in parental control or influence and/or a lower importance to the group in terms of its role in supporting broader group objectives.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Financial Institutions issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of four notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from ‘AAA’ to ‘D’. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit https://www.fitchratings.com/site/re/10111579.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

PUBLIC RATINGS WITH CREDIT LINKAGE TO OTHER RATINGS

Ratings of Serendib, RPF and DF are driven by their parents’ ratings.

(Courtesy – AD Buzz Report)